Federal payroll calculator 2023

The Federal Work-Study FWS Program is a federally subsidized employment program which provides part-time work opportunities for undergraduate and graduate students. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

We also offer a 2020 version.

. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Missouri local counties cities and special taxation districts. Washington has no state income tax. Employment verifications may be sent to the Payroll Office 878-4124.

Some taxes are paid by the employee some by you and some are shared between you and your employee. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips some scholarshipsgrants and unemployment compensation. Premium Tax Credit is an exception.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Afena Federal Credit Union located in Marion Indiana is open to membership in Grant and Wabash County and is committed to help its members reach their financial goals. In as little as 15 minutes significantly reducing processing time and costs.

The FY 2023 rates are NOT the default rates until October 1 2022. Reasonable Accommodations ADASection 504 Risk Management. But instead of integrating that into a general.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Announcements and Updates regarding Open Enrollment 2023. Treasury Securities Direct Deposit.

Human Resources continues to monitor and respond to the worldwide spread of the coronavirus COVID-19. Get answers to frequently asked questions about the Federal Long Term Care Insurance Program FLTCIP. Open Enrollment will be October 31 2022 - November 18 2022.

The White House and Congress have proposed a 46 pay raise for the military in 2023 the largest in nearly two decades. Any potential premium rate increase will not be effective until 2023. However revenue lost to Washington by not having a personal income tax may be made up through other state-level taxes such as the Washington sales tax and the Washington property tax.

Generally people can qualify for the credit if their income is more than 100 of the federal poverty guideline but less. PenSoft Payroll is the best value in payroll. In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion.

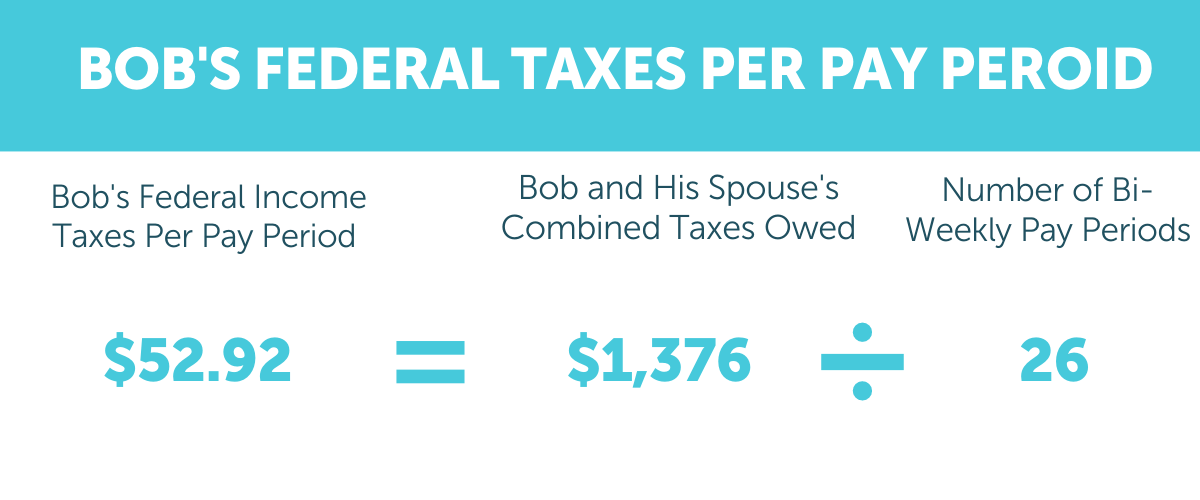

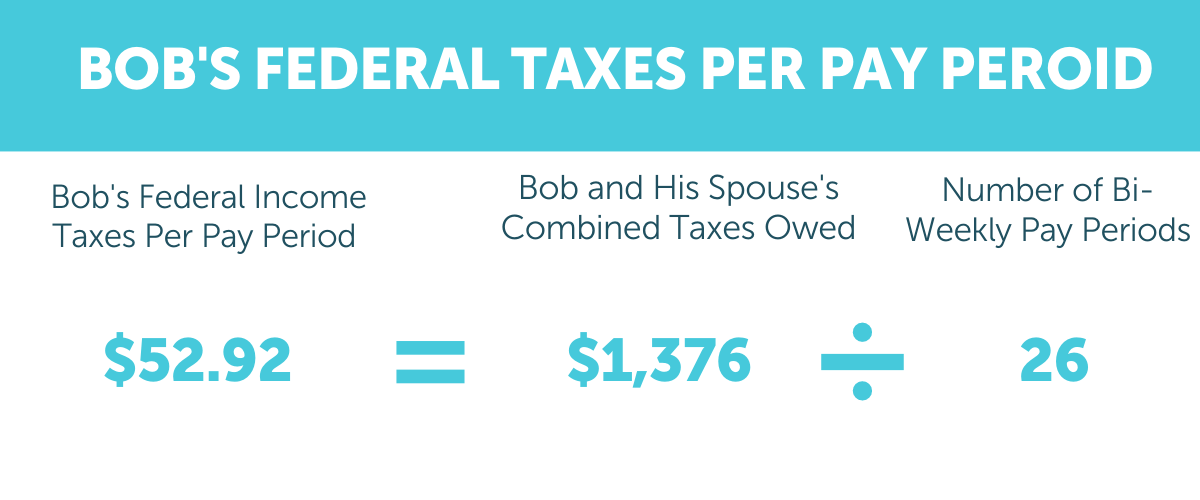

If your EOD falls between January 1 and June 30 you will receive your increment in January 2023. Streamline onboarding benefits payroll PTO and more with our simple intuitive platform. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

The selective service registration question will remain on the FAFSA for the 2021-2022 and 2022-2023 award years but opting out of registering will not affect aid eligibility. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. Enter Personal Information a First name and middle initial.

It had originally closed applications on August 8 2020 but. State Employees Federal Credit Union US. Should I expectask for the holiday payment 13th salary instalment be made in my first month of employment this June.

Your withholding is subject to review by the IRS. Paycheck Protection Program PPP The Paycheck Protection Program offers loans to small businesses to keep employees on payroll and cover certain other expenses during the coronavirus pandemic. Type of federal return filed is based on your personal tax situation and IRS rules.

Open Enrollment for 2023 begins on November 1 2022 and ends on January 15 2023. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Last day you can work if you.

Give Form W-4 to your employer. Proposed Active Duty pay raise for 2023 Proposed Reserve pay raise for 2023. The expenses you pay with an EIDL advance are also fully tax deductible for federal taxes.

How much does FLTCIP coverage cost. The question on the FAFSA will be removed in 2023-2024. Learn about employment payroll and immigration for Portugal to help your company with local legislation.

Product Services. From 1st June 2021 to 30th May 2023. For additional information about Selective Service requirements visit the US Government- Selective Service Website.

Washington is one of seven states that do not collect a personal income tax. Title I Part A - Family School Partnership. Only the Federal Income Tax applies.

When is Affordable Care Act Open Enrollment for 2022-2023. Last name Address. Ensures compliance with all local state federal and territorial tax and wage requirements.

Florida Hourly Paycheck and Payroll Calculator. City or town state and ZIP code. Select FY 2023 from the drop-down box above the Search By City State or ZIP Code or Search by State map.

FY 2023 Per Diem Rates Now Available Please note. Florida employers are responsible for withholding and paying the same federal payroll taxes as employers in the 49 other states. Coordinating Supervisor- Finance.

The purpose of the 21st CCLC program is to provide federal funds to establish or expand community learning centers that operate during. First day you can file your 2023-2024 FAFSA use your 2021 tax information. We sent a notification to FLTCIP 10 FLTCIP 20 and Alternative Insurance Plan AIP enrollees who may be impacted.

If your EOD falls between July 1 and December 31 you will receive your increment in July 2022. The 21 st Century Community Learning Centers CCLC Program is authorized under Title IV Part B of the Elementary and Secondary Education Act ESEA of 1965 as amended by the Every Student Succeeds Act ESSA of 2015. Title I Part A - Improving Academic Achievement.

One tax break specifically tied to the federal poverty guidelines is the Premium Tax CreditThis is a tax break intended to help some people pay for health insurance under the Affordable Care Act also called Obamacare. Annual changes to the federal health insurance marketplace coupled with Affordable. 1300 per hour.

You must follow these instructions to view the FY 2023 rates. Complete all personnel and payroll related paperwork.

When Are Federal Payroll Taxes Due Deadlines Form Types More

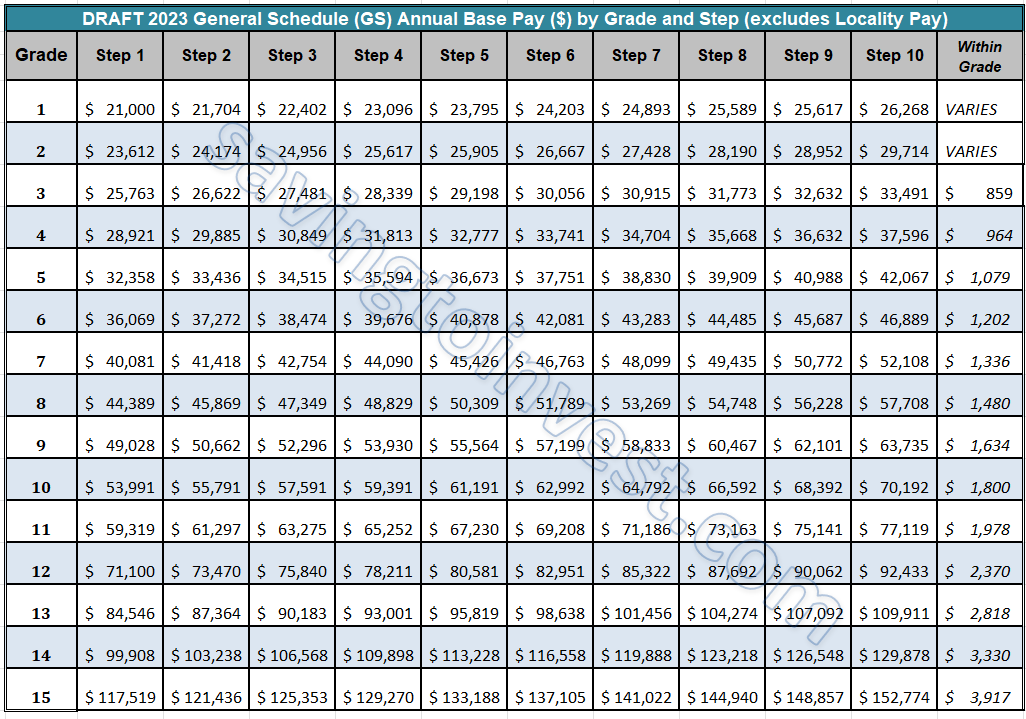

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2022 Federal State Payroll Tax Rates For Employers

Estimated Income Tax Payments For 2022 And 2023 Pay Online

General Schedule Gs Base Pay Scale For 2022

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Salary Math Tutorials

Biden Issues Alternative Pay Letter For 2023 Federal Pay Raise Average 4 6 Raise Fedsmith Com

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Pin On Information

Financial Aid Award Comparison Worksheet Financial Aid For College Grants For College Scholarships For College

2022 Federal Payroll Tax Rates Abacus Payroll

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Pin On Ttcu News

How To Pay Payroll Taxes A Step By Step Guide

2022 Federal State Payroll Tax Rates For Employers

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

Komentar

Posting Komentar